In the growing world of e-commerce, the best payment gateways have become essential for facilitating online financial transactions. Whether you run a small online store or a large company, choosing the right payment gateway can significantly impact your business’s success. The best electronic payment gateway can greatly influence the success of online businesses by providing reliable, secure, and fast payment services, both globally and in Kuwait.

What is an Electronic Payment Gateway?

An electronic payment gateway is an intermediary service that connects your website or application with a bank or payment service provider. This gateway encrypts sensitive payment data, such as credit card numbers, verifies the transaction, and securely transfers the money from the customer’s account to your business account. Electronic payments play a vital role in facilitating these processes, ensuring security and reliability in online money transfers.

Why is Choosing the Right Payment Gateway Important?

An effective electronic payment gateway provides many benefits, including:

- Increased Sales: Offering multiple and easy-to-use payment options encourages customers to complete their purchases. Choosing the best electronic payment gateway can enhance the customer experience and increase conversion rates.

- Improved User Experience: A fast and secure payment gateway leaves a positive impression on customers. Online stores greatly benefit from payment gateways that provide a smooth and secure user experience.

- Reduced Operating Costs: Some payment gateways offer competitive fees and low transaction costs.

- Enhanced Security: Protecting sensitive payment data from fraud and forgery is crucial.

- Global Expansion: If you plan to expand into new markets, choose a gateway that supports different currencies and languages.

UPayments: Innovative Electronic Payment Solutions

UPayments is one of the leading companies providing electronic payment gateway services in the region. UPayments offers innovative and secure payment solutions that meet the needs of various types of businesses. With an easy-to-use interface and excellent customer service, UPayments helps companies improve their payment experience for their customers and increase their online sales. HyperPay is another example of a reliable payment gateway, offering features such as competitive transaction rates, customizable payment pages, and compliance with Kuwaiti regulations, making it suitable for the Kuwaiti and Arab markets.

1. Assess Your Business Needs

Before choosing a payment gateway, it’s crucial to carefully assess your business needs. Consider the following factors:

- Type of Products or Services You Offer: Are you selling physical products or digital services? Do you offer subscriptions or donations?

- Expected Transaction Volume: How many transactions do you expect monthly? What is the average transaction value?

- Target Market: Are you targeting the local or international market? What currencies will you accept? It’s important to choose a payment gateway that supports currencies and languages in Arab countries to meet your business needs in these markets.

2. Costs and Fees

Payment gateway costs vary significantly. Compare different fees carefully before making your decision. Common costs include:

- Monthly Subscription Fees: Some gateways require a fixed monthly fee.

- Transaction Fees: A percentage of the value of each transaction.

- Additional Fees: These may include fees for international transfers or refunds.

Note: Additional fees may vary depending on the payment gateway and services offered.

3. Security and Protection

Security is one of the most important factors to consider when choosing an electronic payment gateway. Ensure that the gateway you choose applies strict security standards to protect your data and your customers’ data.

- Payment Card Industry Data Security Standard (PCI DSS): This standard sets a range of security requirements that companies must follow to protect cardholder data. Ensure the payment gateway you choose is PCI DSS certified.

- Fraud and Forgery Protection: Look for a payment gateway that uses advanced techniques to detect fraud and prevent suspicious transactions. Electronic payments in Saudi Arabia heavily rely on secure payment gateways that help protect businesses and enhance trust between customers and merchants.

- Refund Policy: Check the refund policy of the payment gateway. It should be clear, transparent, and provide protection for both the merchant and the customer in case of any issues.

4. Ease of Integration and Use

The payment gateway you choose should be easy to integrate with your website or application. Ensure it offers an Application Programming Interface (API) that integrates seamlessly with popular e-commerce platforms.

- Integration with E-commerce Platforms: If you use an e-commerce platform like WooCommerce, Shopify, or Magento, make sure the payment gateway integrates easily with it.

- User Interface and Ease of Navigation: The user interface of the payment gateway should be easy to use and intuitive for both the merchant and the customer.

- Technical Support and Customer Service: In case of any issues or inquiries, the technical support team should be available to provide assistance.

Tip: Before making a final decision, test the user interface of the payment gateway to ensure it is easy to use and meets your needs.

5. Supported Payment Methods

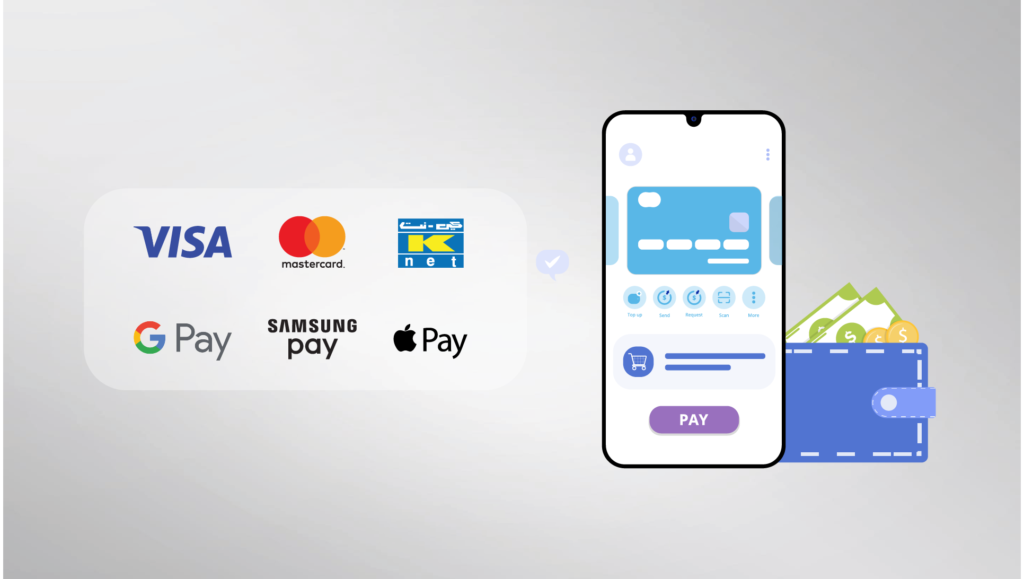

The payment gateway you choose should support a variety of payment methods to meet your customers’ preferences. Common payment methods include:

- Bank Debit Cards: Allow customers to pay directly from their bank accounts.

- Credit Cards: Enable customers to pay on credit with the option of installment payments.

- Digital Wallets and Payment Methods: Such as Apple Pay, Google Pay, and Samsung Pay, which provide a fast and secure payment method using smart devices.

Tip: If you target specific markets, ensure the payment gateway supports popular payment methods in those markets.

6. Speed and Efficiency of Payment Processing

Payment processing should be fast and efficient to ensure a smooth user experience. Make sure the payment gateway you choose excels in the following:

- Transaction Processing Time: The time taken to complete a transaction should be as short as possible to avoid customer frustration. This is especially important in Kuwait, where many companies rely on fast transaction processing to ensure customer satisfaction.

- Transaction Success Rate: The success rate of transaction processing should be high to minimize the number of failed transactions.

- Verification and Settlement Mechanisms: The payment gateway should use effective verification and settlement mechanisms to ensure transaction accuracy and prevent errors.

Conclusion

Choosing the right payment gateway can significantly enhance the success of your online business. UPayments is an ideal choice for many companies due to its innovative, secure solutions, easy-to-use interface, and excellent customer service. By assessing your needs, comparing costs, and verifying security standards, you can choose the payment gateway that suits your business and helps you grow and expand.

Frequently Asked Questions

What are the best electronic payment companies?

UPayments is considered one of the best electronic payment gateways, offering high-quality services and ensuring the security of all electronic transactions. It also provides easy money collection without any obstacles and includes many different payment methods.

How do electronic payment gateways work?

Electronic payment gateways act as intermediaries between the online store and the bank, encrypting the customer’s payment data and sending it to the bank for approval. After approval, the gateway confirms the payment and securely transfers the money to the store’s account.

What are the main disadvantages of electronic payment gateways?

Disadvantages of electronic payment gateways may include transaction fees, which increase costs for merchants. Additionally, technical issues can affect the purchasing process and lead to a loss of trust in the store.